Are you struggling to secure a loan for your real estate project? Traditional lenders can take weeks or months to approve financing, making it difficult to move quickly on investment opportunities. This is where hard money loans offer fast, flexible funding for real estate investors, house flippers, and builders. But what exactly do you need to qualify for one? Let’s dive into the hard money loan requirements and how to secure funding quickly.

What Is a Hard Money Loan?

A hard money loan is a type of short-term financing used by real estate investors, house flippers, and developers to purchase or renovate properties. Unlike traditional mortgages, hard money loans are issued by private lenders and secured by the property rather than the borrower’s credit score.

Why Choose a Hard Money Loan?

Faster Approval

One of the most significant advantages of hard money loans is their fast approval process. Unlike traditional bank loans that take weeks or months, hard money lenders can approve funding in just a few days. This speed allows investors to act quickly on real estate opportunities without unnecessary delays.

Flexible Terms

Hard money loans come with less stringent requirements, making them accessible to a broader range of investors. Even if you have a lower credit score or limited financial history, you can still qualify based on the value of your property. This flexibility makes hard money loans a go-to financing option for real estate investors.

Ideal for Fix & Flip and Construction

If you’re a house flipper or developer, hard money loans are designed for short-term investment projects. Whether you’re buying a distressed property to renovate and sell or need financing for a construction project, these loans provide the quick capital required to complete projects and generate returns efficiently.

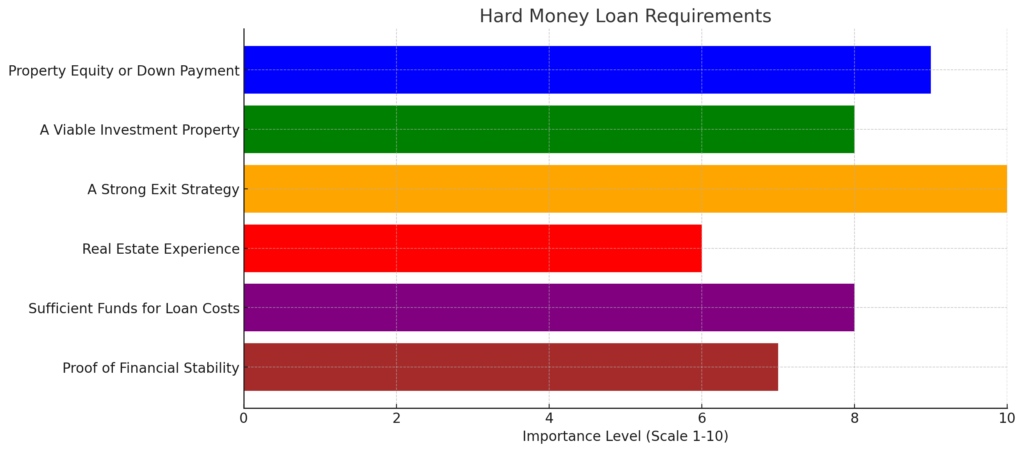

Hard Money Loan Requirements

1. Property Equity or Down Payment

Since the property secures hard money loans, lenders typically require borrowers to have at least 20-30% equity. This could be in the form of:

- A down payment if purchasing a new property

- Existing equity if refinancing or seeking a second lien

2. A Viable Investment Property

Most hard money loans are for non-owner-occupied properties.

Qualifying property types include residential flips, commercial buildings, multi-family units, and construction projects.

3. A Strong Exit Strategy

Hard money loans are short-term (typically 6-24 months), so lenders need to know how you plan to repay the loan. Common exit strategies include:

- Fix & Flip – Selling the property after renovations

- Refinancing – Replacing the loan with a conventional mortgage

- Selling the Property – Paying off the loan with the sale proceeds

4. Real Estate Experience (Preferred but Not Required)

While first-time investors can still get hard money loans, having prior experience in real estate investing can improve your chances of securing better terms and lower interest rates.

5. Sufficient Funds for Loan Costs

Hard money loans involve higher interest rates and fees due to the fast and flexible financing:

- Interest Rates – Typically 8-15% (higher than traditional loans)

- Origination Fees – Usually 1-5% of the loan amount

- Additional Costs – Appraisal fees, underwriting fees, and closing costs

6. Proof of Financial Stability

Unlike banks, most hard money lenders do not require extensive income verification. However, they may ask for essential proof of income or liquidity to ensure you can cover interest payments and renovation costs.

FAQs

1. Can I Get a Hard Money Loan With Bad Credit?

Yes! Hard money lenders focus more on the property’s value than your credit score. However, better credit can help you secure lower rates.

2. How Fast Can I Get a Hard Money Loan?

Approval can happen within 24-48 hours, and funding is typically available in less than a week.

3. What Type of Properties Qualify for Hard Money Loans?

For residential, commercial, fix-and-flip, and construction projects, hard money loans can be used.

4. What Is the Typical Loan Term for Hard Money Loans?

Most hard money loans are short-term, ranging from 6 months to 2 years.

5. Do I Need a Business Entity to Get a Hard Money Loan?

While some lenders prefer lending to LLCs or corporations, many will still approve loans for individual investors.

Final Thoughts

Hard money loans provide quick and flexible financing solutions for real estate investors, but understanding the loan requirements is crucial. Whether you need funding for fix & flip, construction, or investment properties, meeting the proper criteria will improve your chances of securing fast and successful loan approval.

Need Fast and Reliable Funding? Work With Trentium Capital!

If you’re looking for construction loans, fix-and-flip financing, or hard money loans, Trentium Capital is your trusted partner. With quick approvals, flexible terms, and competitive rates, we help real estate investors quickly secure the funding they need!

Fast Approval in 24-48 Hours

Fix & Flip, Construction, and Bridge Loans Available

Flexible Terms for Investors of All Levels

📞 Call Trentium Capital Today to Get Started! Visit Our Website